13-09-2023, 05:54 PM

Pages: 1 2

13-09-2023, 06:03 PM

13-09-2023, 06:05 PM

13-09-2023, 06:11 PM

All this money is stolen from the bank because of their lax security and software flaws.

The UK govt requires companies and banks to pay for money lost due to security flaws that enable the money to be taken.

I just ask a simple question to show the logic of the above

1. If the hardware token was not phased out how many of the scams would occur.

The answer is no. A proper 2 factor authentication requires a separate physical device. Because the banks chose a flaw unsafe system design all these losses happened.

To me the banks are at fault.

The UK govt requires companies and banks to pay for money lost due to security flaws that enable the money to be taken.

I just ask a simple question to show the logic of the above

1. If the hardware token was not phased out how many of the scams would occur.

The answer is no. A proper 2 factor authentication requires a separate physical device. Because the banks chose a flaw unsafe system design all these losses happened.

To me the banks are at fault.

13-09-2023, 06:15 PM

We are told to live with covid like our friends

so we kena shot every 9 mths

Now, we are also indirectly told to live with scammers like our neighbours

will we have to change handphone or ATM cards every 6 mths?

So! What has the most powerful and over-paid Ministers done?

so we kena shot every 9 mths

Now, we are also indirectly told to live with scammers like our neighbours

will we have to change handphone or ATM cards every 6 mths?

So! What has the most powerful and over-paid Ministers done?

13-09-2023, 06:33 PM

With a weak Govt, the Banks and business in general have not been showed their responsibility or penalties. 2 weeks ago at POSB Bank Branch, an immature middle age lady in POSB Tee- shirt standing at the enltrance told me, you all anyhow click and lose money is not our fault.

Her statements is claiming people anyhow click and worse, she is stating POSB is never wrong which is utter nonsense.

Her statements is claiming people anyhow click and worse, she is stating POSB is never wrong which is utter nonsense.

13-09-2023, 06:45 PM

(13-09-2023, 06:33 PM)Symmetry Wrote: [ -> ]With a weak Govt, the Banks and business in general have not been showed their responsibility or penalties. 2 weeks ago at POSB Bank Branch, an immature middle age lady in POSB Tee- shirt standing at the enltrance told me, you all anyhow click and lose money is not our fault.

Her statements is claiming people anyhow click and worse, she is stating POSB is never wrong which is utter nonsense.

I don't have a PayNow account, but seems to me that DBS security is quite lax as there isn't any 2FA imposed when one is changing the PayNow transfer limit.

![[Image: 2023-09-13-18-35-59-1.png]](https://i.ibb.co/fHgz77w/2023-09-13-18-35-59-1.png)

https://www.dbs.com.sg/personal/support/...limit.html

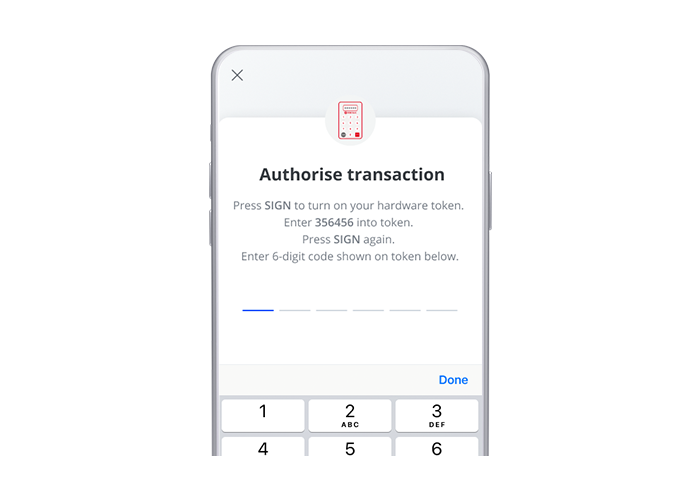

OCBC seems much safer as the hardware token is still required:

https://www.ocbc.com/personal-banking/di...imits.page

13-09-2023, 07:04 PM

(13-09-2023, 06:33 PM)arn fully from papnever wrongwrong is yr faultSymmetry Wrote: [ -> ]With a weak Govt, the Banks and business in general have not been showed their responsibility or penalties. 2 weeks ago at POSB Bank Branch, an immature middle age lady in POSB Tee- shirt standing at the enltrance told me, you all anyhow click and lose money is not our fault.

Her statements is claiming people anyhow click and worse, she is stating POSB is never wrong which is utter nonsense.

learn faithfully n well from the govt never wrong always right

13-09-2023, 07:09 PM

(13-09-2023, 06:11 PM)sgbuffett Wrote: [ -> ]All this money is stolen from the bank because of their lax security and software flaws.i concur g\fully w u

The UK govt requires companies and banks to pay for money lost due to security flaws that enable the money to be taken.

I just ask a simple question to show the logic of the above

1. If the hardware token was not phased out how many of the scams would occur.

The answer is no. A proper 2 factor authentication requires a separate physical device. Because the banks chose a flaw unsafe system design all these losses happened.

To me the banks are at fault.

i hv been asaking for the rtn of physical token n mentioned that mas dont care less on this security

mas shld enforce the banks n cr cards companies to hv the physical token as 2nd factor AUTH enation or let depositors cr cards users hv a choice

13-09-2023, 07:20 PM

No fault pointing culture pls

13-09-2023, 07:25 PM

(13-09-2023, 07:04 PM)talky Wrote: [ -> ]learn faithfully n well from the govt never wrong always right

It is not difficult scammers to by- pass OTP

Are we to blame for scam experts that the bank cannot defeat?

Hackers pose as bank customers by stealing OTPs, making $500k in fake credit card payments | The Straits Times

13-09-2023, 09:05 PM

(13-09-2023, 06:11 PM)sgbuffett Wrote: [ -> ]All this money is stolen from the bank because of their lax security and software flaws.Tot you missed the news

The UK govt requires companies and banks to pay for money lost due to security flaws that enable the money to be taken.

I just ask a simple question to show the logic of the above

1. If the hardware token was not phased out how many of the scams would occur.

The answer is no. A proper 2 factor authentication requires a separate physical device. Because the banks chose a flaw unsafe system design all these losses happened.

To me the banks are at fault.

The UK govt requires companies and banks to pay for money lost due to security flaws that enable the money to be taken.

The UK govt requires companies and banks to pay for money lost due to security flaws that enable the money to be taken.14-09-2023, 09:33 AM

(13-09-2023, 06:33 PM)Symmetry Wrote: [ -> ]With a weak Govt, the Banks and business in general have not been showed their responsibility or penalties. 2 weeks ago at POSB Bank Branch, an immature middle age lady in POSB Tee- shirt standing at the enltrance told me, you all anyhow click and lose money is not our fault.

Her statements is claiming people anyhow click and worse, she is stating POSB is never wrong which is utter nonsense.

The Banks got it all wrong. It is our phone and we can watch/ download whatever we want. Clearly, it is their job to ensure that the money saved in the Bank is safe and secure.

14-09-2023, 09:33 AM

In Sg, confirm not the banks lah.

19-09-2023, 08:32 AM

19-09-2023, 08:44 AM

Banks are the ones who got rid of hardware tokens to save money.

They developed the the security and app but forgot to take into account the features on the OS of the phones that make customers vulnerable to scammers.

In addition banks implemented transfer mechanisms that allow money to be moved quickly without strong traceability and checks.

Banks should compensate 100%

They developed the the security and app but forgot to take into account the features on the OS of the phones that make customers vulnerable to scammers.

In addition banks implemented transfer mechanisms that allow money to be moved quickly without strong traceability and checks.

Banks should compensate 100%

19-09-2023, 08:56 AM

If it is compulsory.

Then some will claimed to be scammed.

Physical token is a better method of prevention. Especially for the elderly. It should be optional.

Then some will claimed to be scammed.

Physical token is a better method of prevention. Especially for the elderly. It should be optional.

19-09-2023, 09:00 AM

It’s getting so scary that ppl loses life savings yet the govt is still taking slow steps wait and see.

19-09-2023, 09:01 AM

You got scammed knowingly banks will pay.

Scammer will share part of gain for your cooperation.

So you become a Scammer too.

Dumb gets dumber.

Scammer will share part of gain for your cooperation.

So you become a Scammer too.

Dumb gets dumber.

19-09-2023, 09:09 AM

(19-09-2023, 08:56 AM)moonrab Wrote: [ -> ]If it is compulsory.

Then some will claimed to be scammed.

Physical token is a better method of prevention. Especially for the elderly. It should be optional.

Im willing to pay the token from my own pocket

19-09-2023, 09:16 AM

(19-09-2023, 09:09 AM)CHAOS Wrote: [ -> ]Im willing to pay the token from my own pocket

Bank should bear the cost.

They making billions $.

Especially the local ones.

DBS bought over our POSB with no cash. They owe responsibility to Singaporean.

19-09-2023, 09:21 AM

something is wrong here. Not beri long ago we hardly ever come to hear any scam.

Now scams everywhere.

Up to no good.

u know wat i mean?

Now scams everywhere.

Up to no good.

u know wat i mean?

19-09-2023, 10:01 AM

(19-09-2023, 09:21 AM)singlon Wrote: [ -> ]something is wrong here. Not beri long ago we hardly ever come to hear any scam.

Now scams everywhere.

Up to no good.

u know wat i mean?

Not very long ago, people never use computer and not IT savvy lah. Now people are good in IT but want to be rich fast and furious lah. That is why lor

19-09-2023, 12:09 PM

(19-09-2023, 09:01 AM)Migrant Wrote: [ -> ]You got scammed knowingly banks will pay.

Scammer will share part of gain for your cooperation.

So you become a Scammer too.

Dumb gets dumber.

Nobody will ever want to be scammed! But let us be mindful of the few different types of scams.

the banking apps are full of loopholes allowing apk files to activate the banking transactions.

19-09-2023, 12:29 PM

It’s their responsibility to keep customers money safe

19-09-2023, 12:41 PM

So simple. Withdraw all the $$$ out from the banks who don’t want to reimburse. Only deposit $$$ to banks who are willing to reimburse

19-09-2023, 01:00 PM

Use China banks lor

19-09-2023, 01:06 PM

No choice now got to check online everyday

19-09-2023, 01:06 PM

I dunno why MAS is not doing anything about it. LW is a jlb!

19-09-2023, 01:10 PM

what to do ,we have a wastrel son of sg. lot of minister also do nothing. this gov you all still wants.

Pages: 1 2